Updates to OIG’s Area of Focus on Care & Safety of Nursing Facility Residents

Written by Kirsten Taylor-Billups, JD, RN, CHC

The Nursing Facility Industry Specific Compliance Guidance was published by the Office of Inspector General (OIG) in November 2024 as the first industry-specific guidance since the November 2023 updated general compliance guidance was published. Improving the quality of care and safety of residents within nursing facilities is a top priority for OIG. Quality of care and safety are matters of critical importance for residents, their loved ones, and the nursing facility workforce. The Nursing Facility ICPG, together with the GCPG, addresses the Government and private industry’s shared goals of reducing fraud, waste, and abuse; promoting cost-effective and quality care; enhancing the effectiveness of providers’ operations; and propelling improvements in compliance, quality of care, and resident safety within nursing facilities.

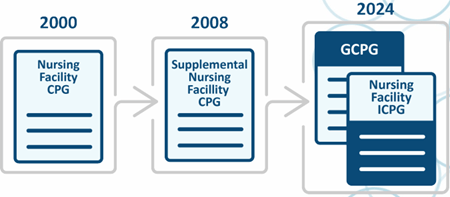

The Office of Inspector General (OIG) continues to have nursing facilities on their radar for compliance guidance and workplans. We’re too far into the year 2025 to say “Happy New Year” but your nursing facilities aren’t too far along into the new year to revise their compliance programs auditing and monitoring tools. In late 2024, OIG released the Nursing Facility Industry Segment Specific Program Guidance (ICPG) which is the OIG guidance for post-acute nursing facilities to update and individualize your compliance programs to promote quality of life, quality of care, risk areas. Together with the General Compliance Guidance Program (GCPG), nursing can mitigate risks as well as other important information OIG believes nursing facilities should consider when implementing, evaluating, and updating their compliance and quality programs. This illustration is from the OIG demonstrating the migration of compliance guidance’s for nursing facilities:

In addition to the ICPG’s release the OIG’s monthly workplan updates should also be considered when updating your compliance programs for your nursing facilities. Upon review of the nursing home focused workplans you’ll see how they correlate with the topics detailed in the ICPG.

Although the Industry Segment Specific Program Guidance (ICPG) for Nursing Homes is not mandatory, the Requirements of Participation for Nursing Home compliance (ROP) which are modeled after the OIG’s Compliance Guidelines, are mandatory.

Nursing homes must adhere to the ROPs established by the Centers for Medicare & Medicaid Services (CMS) to receive reimbursement for Medicare and Medicaid patients. The Compliance Program (ROPs) for nursing facilities include the seven elements the OIG have identified to promote an effective compliance program:

- Compliance Policies and Procedures/Compliance Officer are to ensure that all federal and state regulations are being followed;

- Training/Education of staff on compliance requirements which the policies and procedures are patterned after;

- Auditing/Monitoring which requires routine audits of billing practices, overpayment rates and ethics practices and to ensure staff are following compliance and ethics policies and procedures;

- Reassessments/Modifications to one’s compliance program to address identified weaknesses or changes in regulations;

- Addressing Quality of Care Issues to ensure care planning is up to date and accurate;

- Preventing Abuse with the development of policies and procedures to prevent abuse and neglect; and

- Enforcement of disciplinary mechanisms consistently for violations of compliance and ethics policies/procedures and regulations.

The implementation of these seven elements can be utilized to mitigate fines, penalties and enforcements of Corporate Integrity Agreements (CIAs) with the government if violations are identified.

The OIGs Nursing Home ICPG and Workplan recommendations are based upon decades of findings and observations on matters involving nursing homes from audits, investigations, enforcement actions and monitoring of Corporate Integrity Agreements (CIA). The recommendations are also based upon legal actions and investigations by the OIG current enforcement priorities and interactions with owners, operators and leaders of nursing homes, trade associations, resident advocacy groups, and other industry stakeholders.

Agencies Working Together – The OIG, CMS and the Department of Justice (DOJ) and other law enforcement agencies have been working in a concerted effort to pursue nursing facilities that provide grossly substandard care that is being submitted for billing. The government looks at the bills as being fraudulent because the care and services were so inadequate, as if the care and services weren’t provided.

Use the Guidance as a Road Map – The ICPG and Workplans both serve as road maps to help nursing facilities focus their efforts on issue self-identification and corrective actions to minimize the likelihood of civil, criminal or administrative noncompliance. The ICPG has been written to identify specific categories of compliance risk areas such as quality of care and life, Medicare and Medicaid billing requirements, federal anti-kickback statute as well as other areas of risk such as physician self-referrals, anti-supplementation, privacy and security issues within post-acute care facilities. The list of risks isn’t all inclusive, but it is a good starting point. Facility risk assessments can also be used to formulate audit tools and develop action plans so corrective actions can be implemented and operationalized to demonstrate an effective compliance program because compliance manuals sitting on a shelf aren’t going to be adequate.

The OIG currently has 13 active workplans targeted for nursing homes, some of which have been active since 2023 and are being revised and are being brought forward into 2024-2026 compliance OIG reviews. Upon further review of these workplans they primarily fall into two categories. One category being Financial (1-5) and the other category being Quality of Care and Life (6-13):

- Skilled Nursing Facilities (SNF) Medicare Payments to Related Parties;

- SNFs billing accuracy of Patient Driven Payment Model (PDPM) reimbursement system;

- Billing of Medicare part B services during a Medicare Part A stay;

- Supplemental Payments for Medicaid;

- SNFs Financial Responsibility for Medicare Part D enrollee(s) Medication During Part A stays;

- Potentially Preventable Hospitalizations;

- Employee Background Checks;

- Infection Prevention and Control;

- Accuracy of Reported Falls;

- Staffing Hours;

- Emergency Power Systems;

- Accurate and appropriate Reporting; and

- Usage of Antipsychotic Medications.

These 13 active workplans should be incorporated into your compliance reviews to some degree as well as conducting periodic audits to ensure your facility is compliant.

OIG’s Financial Focus – The OIGs review of SNFs Medicare payments to related parties includes the cost of services, facilities, and supplies furnished to a provider by an organization, related to the provider by common ownership or control. The allowable cost to the provider should only be an amount equal to the related organization’s cost not to exceed the price of comparable services, facilities, and supplies that could be purchased elsewhere.

- Medicare requires that a reported amount be the lower of either the actual cost to the related organization or the market price for comparable services, facilities, or supplies, thereby removing any incentive to realize profits through these transactions.

- The OIGs audit examined whether selected SNFs reported related parties as required 42 CFR 413.17 (d) and whether their related-party costs complied with Medicare requirements. The review is partially complete, and the OIG identified SNFs weren’t following proper reporting requirements for payments to related parties. Therefore, OIG made 3 recommendations to CMS to correct the issues and CMS adopted 2 of the 3 recommendations.

- CMS agreed to develop and implement guidance for SNFs on the appropriate methods for providers to determine their allowable related-party costs; and provide guidance to reeducate MACs on the need to review, grant, and document requests from SNFs for exceptions to cost reporting requirements in compliance with 42 CFR §413.17(d).

Given the OIG has forwarded this area of review into FY 2025 it would be prudent of your own facilities to become familiar with the related parties’ cost report requirements and review your cost reports for allowable related provider cost to determine if your facility is following the regulations. If not, implement an action plan to correct the deficiencies identified.

The other areas of financial focus by the OIG include their review of nursing facility Skilled Nursing reimbursement, Medicare Part B services during a Medicare Part A stay, Supplemental Payments for Medicaid and lastly SNFs Financial Responsibility for Medicare Part D enrollee(s) Medications during Part A stays. These reviews should already be on your annual compliance audit tools to some degree to measure your facilities level of general billing compliance. However, it does help to narrow your focus and identify the areas being reviewed by the OIG in the above listed areas.

When conducting a review of a skilled facilities reimbursement, the review can go back as far as 2019 when the CMS implemented a new payment system Payment Driven Payment Model (PDPM) for determining Medicare Part A payments to skilled nursing facilities. Specifically, CMS implemented the Patient Driven Payment Model (PDPM), a new case-mix classification system for classifying SNF patients in a Medicare Part A covered stay into payments groups under the SNF Prospective Payment System.

Under PDPM, payment is determined by factoring in a combination of six payment components. Five of the components are case-mix adjusted and include a physical therapy component, an occupational therapy component, a speech-language pathology component, a nontherapy ancillary services component, and a nursing component. Additionally, there is a non-case-mix adjusted component to cover utilization of SNF resources that do not vary according to patient characteristics. OIG will determine whether Medicare payments to SNFs under PDPM complied with Medicare requirements.

When it comes to Medicare part B services during a Medicare Part A stay the OIG will determine whether Part B payments to Medicare beneficiaries in NHs are appropriate and whether nursing facilities have effective compliance programs and adequate controls over the care provided to their residents. Medicare pays physicians, non-physician practitioners, and other providers for services rendered to Medicare beneficiaries, including those residing in nursing homes (NHs).

- Most of these Part B services are not subject to consolidated billing; therefore, each provider submits a claim to Medicare.

- Since the 1990s, OIG has identified problems with Part B payments for services provided to NH residents. An opportunity for fraudulent, excessive, or unnecessary Part B billing exists because NHs may not be aware of the services that the providers bill directly to Medicare, and because NHs provide access to many beneficiaries and their records.

OIG review of Supplemental Payments from CMS has approved Medicaid nursing facility upper payment limit (UPL) supplemental payment programs in several states. In these States, nursing facilities may be eligible for supplemental payments that, when combined with a base payment, may not exceed a reasonable estimate of the amount that Medicare would pay for the services.

- Under the UPL supplemental payment programs, a State may use a variety of financing mechanisms to fund that State’s share of supplemental payments.

- Medicaid will determine whether payments States claimed under their Medicaid supplemental payment programs complied with Federal and State requirements and describe how those payments were distributed and used.

- A review of your cost reports on how your facility utilizes Medicaid UPL payments should be analyzed to determine if your facility is following the regulation.

Last of the financial Workplans is the OIGs review of SNFs financial responsibility for Medicare Part D enrollee(s) medication during Part A stays and whether SNFs complied with federal requirements for assuming financial responsibility for drugs for Part D enrollees in Part A SNF stays.

- Medicare Part A prospective payments to skilled nursing facilities (SNFs) cover most services, including drugs and biologicals, furnished by a SNF for use in the facility for the care and treatment of enrollees.

- Accordingly, Medicare Part D drug plans should not pay for prescription drugs related to posthospital SNF care, because payment for the drugs is included in the prospective payment for a Part A SNF stay. A prior OIG audit found that up to $465.1 million in part D total cost was improperly paid for drugs for which payment was available under the part A SNF benefit. That audit also found that some of the drugs administered to part D enrollees during their Part A SNF stays had been provided to the SNFs by the enrollees or their families, even though the SNFs were financially responsible for providing the drugs. For this audit, the OIG will determine whether SNFs complied with federal requirements for assuming financial responsibility for drugs for part D enrollees in part A SNF stays.

When it comes to OIGs active workplans that target quality of care and life areas your organization should focus on the following: Preventable hospitalizations of skilled residents, employee background checks, infection prevention and control, accuracy of documentation of falls and antipsychotics, staffing and emergency systems.

When it comes to potentially preventable hospitalizations of Medicare-eligible skilled nursing residents prior CMS studies found that five conditions (pneumonia, congestive heart failure, UTIs, dehydration, and chronic obstructive pulmonary disease/asthma) constituted 78 percent of the long-term care resident transfers to hospitals, according to the OIG Oct 2022 Workplan item. Additionally, sepsis is often considered a preventable condition when the underlying cause of sepsis can be prevented during the stay.

OIG’s review of claims shows that skilled nursing facility (SNF) residents often present with one of these six conditions (pneumonia, congestive heart failure, UTIs, dehydration, chronic obstructive pulmonary disease/asthma, and sepsis) on inpatient hospitalization. The OIG will review inpatient hospitalizations of SNF residents with any of these six conditions and determine whether the SNF provided services to residents in accordance with their care plans and professional standards of practice (42 CFR § 483.21 and 42 CFR § 483.25).

The CMS National Background Check Program established the framework for a nationwide program to conduct background checks on a statewide basis on all prospective direct patient access employees of long term care (LTC) facilities and providers. LTC facilities and providers include skilled nursing and nursing facilities, home health agencies, hospice and personal care providers, LTC hospitals, residential care providers arranging for or providing LTC services, and intermediate care facilities for individuals with intellectual disabilities.

- The program’s purpose is to identify efficient, effective, and economical procedures for conducting background checks. The program will be administered by the Centers for Medicare & Medicaid Services (CMS), in consultation with the Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI).

- OIG work has shown that not all States complied with the National Background Check program for LTC providers. The OIG will determine whether Medicaid beneficiaries in nursing homes in selected States were adequately safeguarded from caregivers with a criminal history of abuse, neglect, exploitation, mistreatment of residents, or misappropriation of resident property, according to Federal requirements.

- A random review of your facilities employees’ human resources personnel records for background checks should be standard on your compliance audits and cross references with disciplinary actions of employees.

Audit of Nursing Home Infection Prevention and Control Program Deficiencies – The OIGs nursing home infection prevention and control program deficiency’s objective is to determine whether selected nursing homes have programs for infection prevention and control and emergency preparedness in accordance with Federal requirements. Severe weather events have highlighted the need for and importance of emergency power systems for nursing homes.

- In 2023 the OIG announced their review of emergency systems which is still an active area of focus for 2025. Nursing homes are required to provide an alternate source of energy (usually a generator) to maintain temperatures to protect residents’ health and safety, as well as for food storage, emergency lighting, fire protection, and sewage disposal (if applicable), or to evacuate the residents.

- Nursing homes with generators must have them installed in a safe location and are required to perform weekly maintenance checks. During OIG onsite inspections of 154 nursing homes in eight States as part of our recent life safety and emergency preparedness audits, numerous facilities that had generators that were more than 30 years old.

- The OIG plans to conduct ongoing audits to determine the age of nursing home emergency power systems and whether the systems sustain the well-being and safety of their residents. The emergency plans will have to be able to reliable and maintain emergency power, food and water supplies, as well as have alternative facilities for residents who may need to be evacuated per federal regulations.

The “PBJ” – OIG also announced in 2023 their audit of staffing hours reported through the Payroll-Based Journal (PBJ). The PBJ data is used by CMS and other stakeholders to monitor nursing home staffing levels, assess quality of care, and identify compliance issues. The OIG is expected to issue audit findings in 2025.

- Nursing homes are required to electronically submit complete and accurate direct care staffing information to CMS’s Payroll-Based Journal (PBJ) system on a quarterly basis.

- Direct care staff include nurse and non-nurse staff who, through interpersonal contact with nursing home residents or resident care management, provide care and services to residents to allow them to attain or maintain the highest practicable physical, mental, and psychosocial well-being.

CMS and other stakeholders use the staffing information in the PBJ to:

- measure nursing home performance;

- better understand the relationship between nursing home staffing levels and the quality of care that nursing homes provide;

- identify noncompliance with Federal nurse staffing regulations; and

- facilitate the development of nursing home staffing measures.

OIG will audit the nursing staffing hours reported in the PBJ to determine whether the reported hours are accurate and meet regulatory staffing ratios.

Quality of Care – When it comes to Quality of Care, the OIG has actively focused on clinical areas that are high risk, cause serious injuries, increase cost and documentation manipulated to avoid regulatory review. The primary clinical areas targeted are falls and antipsychotic medication prevalence, negative impact and reporting accuracy on the long-term care beneficiaries. The OIGs active review of these clinical measures was in 2023 while falls were announced in 2024, and they both remain on the active workplan for 2025-2026.

- In the Medicare and Medicaid programs, when a nursing home resident experiences a fall, the nursing home is required to report that fall, and the severity of any resulting injury, in a patient assessment.

- CMS then uses this information to determine, for each Medicare-certified nursing home, the percentage of residents experiencing falls resulting in major injury. This percentage is posted on CMS’s Care Compare website to give consumers information about the relative performance of each nursing home.

- The OIG will assess the accuracy of the patient assessment data used to calculate nursing home falls rates, identify hospitalizations due to falls with major injury among Medicare enrollees receiving nursing home care using Medicare claims. In the first study, the OIG assessed the extent to which those falls were reported by nursing homes in patient assessments. A review of the characteristics of the people who did not have their falls reported and consider the characteristics of nursing homes that did not report falls among their residents.

- The OIG will provide additional details about the falls with major injury and hospitalization identified, which could include the amount of time spent in the hospital, the cost of the hospital stays to the Medicare program and enrollees, and outcomes to determine over coding and billing issues.

Use of antipsychotic drugs – The potentially inappropriate use of antipsychotic drugs among nursing home residents remains a concern despite efforts to decrease their use over the last decade. Antipsychotic drugs were developed to treat schizophrenia—a serious mental disorder that is generally diagnosed before the age of 30. These powerful drugs are known to have severe side effects, particularly among elderly individuals with dementia.

- In 2008, the Food and Drug Administration issued a boxed warning against the use of all antipsychotic drugs among elderly individuals with dementia because of the increased risk of death.

- OIG raised concerns about the high use of antipsychotic drugs among nursing home residents, and in response, CMS took steps to discourage the use of these drugs by, for example, developing publicly reported quality measures related to the use of antipsychotic drugs among nursing home residents.

More recently, OIG has raised concerns about the potential falsification of schizophrenia diagnoses to make the use of antipsychotic drugs appear appropriate and avoid Federal attention. OIG will conduct an in-depth review of survey reports to:

- examine the nature of nursing home citations related to the use of antipsychotic drugs; and

- identify vulnerabilities that contribute to the inappropriate use of these drugs.

Conclusion

In summary, your nursing facility compliance audit tools should be comprehensive and updated based upon the trends within the post-acute care nursing home healthcare arena. A comprehensive compliance program should reflect question sets that should include the guidance provided by the newly released Nursing Home Industry Segment Specific Program Guidance to help you target your audits. The OIG’s active Workplans specifically focused on nursing homes should also be taken into consideration. As mentioned, the OIG developed these tools on regulatory findings, some of which have resulted in federal settlements, Compliance Integrity Agreements and negative trends in the industry that resulted in recommendations to CMS. CMS, being the deciding entity, adopted some of the OIG’s recommendations and dismissed others. Despite CMS not acting on all the OIG’s recommendations as a proactive measure the OIG’s findings should be considered, and a sample review of your nursing facilities should be conducted to help emphasize how advanced and proactive your audit and monitoring process may help to mitigate in future regulatory review for your facilities.

About the Author Kirsten Taylor-Billups

Kirsten Taylor-Billups is the owner and operator of Legal Healthcare Consulting, with 35 years of experience in acute and post-acute care. She holds the qualifications of Registered Nurse (RN), Juris Doctorate Degree (JD), and Certification in Healthcare Compliance (CHC). Over her 30-year tenure in healthcare, Kirsten has undertaken various roles, including Director of Nursing, Quality Assurance Consultant, Risk Manager, and Corporate Compliance Officer at multi-facility healthcare organizations such as University Hospitals, HCR ManorCare, Common Spirit Health, and Catholic Healthcare Initiatives.

Legal Healthcare Consulting, founded by Kirsten 30 years ago, offers expert services to government contractors and acute and post-acute care facilities in capacities including Chief Compliance Officer, Risk Manager, Quality Assurance Consultant and Mediation services. Kirsten’s extensive expertise and experience are invaluable assets. She can be contacted via cell at (216) 385-0008 or email Ktaylor7284@legalhealthcareconsulting.com.

Copyright © 2025 American Institute of Healthcare Compliance All Rights Reserved