Written by: AIHC Blogger

This article provides educational information related to fighting unreasonable denials by working through a complex payer appeals process. This information is not all-inclusive and the article is a truncated version of Lesson 3 from our Certified Outpatient Clinical Appeals Specialist (COCASSM) training program. The complex Medicare appeals process is used to demonstrate the importance of appealing claims denied in an audit. Make sure to read Part 1: Managing Denials is Important to Good A/R Hygiene.

Audited by a payer?

Is your organization under a payer audit? Fight back by appealing unreasonable denials. But first, learn more about how a complex payer audit system works.

Understanding how a payer reviews and makes a payment determination will strengthen your ability to argue and defend your claim upon appeal. The learning objective of this lesson is to help you become familiar with the Medicare Claims Review Program (MCRP). This program monitors inappropriate payments. Other payers mirror Medicare’s program.

What is an “improper” payment?

These are reimbursements that should not have been made or that were made in incorrect amounts. According to the U.S. Government Accountability Office (GAO), improper payments have been estimated to total almost $1.7 trillion government-wide from fiscal years 2003 through 2019. Auditing and denying claims after the claims have been paid is “big money” for the government.

- For example, the GAO states that they identified about $77.6 billion in financial benefits in fiscal year 2020—a return of about $114 for every $1 invested.

- They also identified 1,332 other benefits that led to program and operational improvements across the government.

- Most recently, GAO has been evaluating the largest response to a national emergency in US history, the $2.6 trillion COVID-19 response legislation, and making recommendations about how to improve its effectiveness in dealing with public health issues and the economy.

The Medicare Fee-for-Service Compliance programs prevent, reduce, and measure improper payments in FFS Medicare through medical review. A number of programs are provided to educate and support Medicare providers in understanding and applying Medicare FFS policies while reducing provider burden.

A Medicare contractor may use any relevant information they deem necessary to make a prepayment or post-payment claim review determination. This includes any documentation submitted with the claim or through an additional documentation request.

CMS' Center for Program Integrity (CPI) oversees Medicare medical review contractors. CPI conducts contractor oversight activities such as:

- Providing broad direction on medical review policy

- Reviewing and approving Medicare contractors' annual medical review strategies

- Facilitating Medicare contractors' implementation of recently enacted Medicare legislation

- Facilitating compliance with current regulations

- Ensuring Medicare contractors' performance of CMS operating instructions

- Conducting continuous monitoring and evaluation of Medicare Contractors' performance in accord with CMS program instructions as well as contractors' strategies and goals

- Providing ongoing feedback and consultation to contractors regarding Medicare program and medical review issues

The Medicare Claims Review Program, or “MCRP,” involves both technical and clinical categories of denials performed by CMS contractors. It is a complex system, perfect to use as a teaching example! There are two categories of denials:

1. Technical Denial & Rejection

• This topic has been covered in previous lessons, but let’s review again!

o A technical denial is an error made when filing the claim, such as lack of appropriate coordination of benefits and filing to secondary insurance first. When a critical error gets through the scrubber, the insurance payer software may reject the claim due an error. Correcting these types of errors quickly and refiling the claim typically results in payment. These claims often “fall through the cracks” and can be suspended. Lack of tending to rejected claims can cause huge revenue loss for your organization.

2. Clinical Denial

• A clinical denial is the denial of payment by an insurance payor on the basis of medical necessity, length of stay or level of care. Special review of documentation, payer guidelines and often appealing the claim is required to obtain payment.

o When a payer sends an RFI (Request for Information), the payer is auditing the claim data against medical record documentation.

o Untimely response to the RFI will result in a denial.

o Sending inappropriate or wrong information to the payer will result in a denial.

o These types of denials can potentially trigger a larger audit, a probe, or an abuse or fraud investigation of your organization

CMS estimates the Medicare FFS improper payment rate through the Comprehensive Error Rate Testing (CERT) program. Each year, the CERT program reviews a statistically valid stratified random sample of Medicare FFS claims to determine if they were paid properly under Medicare coverage, coding, and payment rules.

Audits or claim reviews are conducted either prepayment or post-payment of the claim and typically fall under one of these categories:

- Compliance to bundling edits (Medicare’s National Correct Coding Initiative or NCCI Edits)

- Medically Unlikely Edits or “MUEs”

- Comprehensive Error Rate Testing (CERT)

- Recovery Audit Program

- Medical Reviews (MRs)

National Correct Coding Initiative (NCCI) Edits

CMS developed the National Correct Coding Initiative (NCCI) to promote national correct coding methodologies and to control improper coding leading to inappropriate payment in Part B claims. The Centers for Medicare & Medicaid Services (CMS) owns the NCCI program and is responsible for all decisions regarding its contents.

Most payers either use the NCCI edits or have a similar bundling edit system in place. Basically, bundling edits review codes on a claim to determine whether the items can be filed and paid separately or bundled into one code.

The claims scrubber software within your practice management system will analyze the codes on the claim and compare the information to the NCCI edits. Items that should be bundled will be suspended for further review. Your office cannot bill a patient for a service denied due to denied claims based on the NCCI edits.

These edits are updated at least quarterly and revised in your practice management system through updates to the software. Information about the National Correct Coding Initiative (NCCI) can be found in the Internet-Only Manual, Publication 100-04, Section 20.9 of Chapter 23 of the Medicare Claims Processing Manual.

When appealing NCCI edit denials, it is important to review the claim to ensure the appropriate modifier has been used. If not, review the documentation and appropriately append the modifier to the line item on the claim and submit your appeal with the documentation.

Modifiers allowed with the National Correct Coding Initiative (NCCI) procedure to procedure (PTP) edit that can be used under appropriate clinical circumstances to bypass an NCCI PTP edit include:

- Anatomic modifiers: E1-E4, FA, F1-F9, TA, T1-T9, LT, RT, LC, LD, RC, LM, RI

- Global surgery modifiers: 24, 25, 57, 58, 78, 79

- Other modifiers: 27, 59, 91, XE, XS, XP, XU

NOTE: Overuse of such modifiers just to get claims passed through the edits for payment can trigger an audit, probe or investigation.

Medically Unlikely Edit (MUE)

This audit feature analyzes a claim to determine if the appropriate number of units are being reported per line item. It is a unit of service edit for a Healthcare Common Procedure Coding System (HCPCS)/Current Procedural Terminology (CPT) code for services rendered by a single provider/supplier to a single beneficiary on the same date of service (DOS).

The ideal MUE is the maximum unit of service that would be reported for a HCPCS/CPT code on the vast majority of appropriately reported claims.

MUEs are designed to reduce errors due to clerical entries and incorrect coding. MUEs are adjudicated either as claim line edits or DOS edits.

- If the MUE is a claim line edit, each line of a claim is adjudicated against the MUE value for the Healthcare Common Procedure Coding System (HCPCS)/Current Procedural Terminology (CPT) code on that claim line.

- If the UOS on the claim line exceeds the MUE value, all UOS for that claim line are denied. If the same code is reported on more than one line of a claim by using CPT modifiers, each line of the claim is adjudicated separately against the MUE value of the code on that claim line.

For Medically Unlikely Edits (MUEs) that are adjudicated as claim line edits, each line of a claim is adjudicated separately against the MUE value for the code on that line. The appropriate use of Healthcare Common Procedure Coding System (HCPCS)/Current Procedural Terminology (CPT) modifiers to report the same code on separate lines of a claim will enable a provider/supplier to report medically reasonable and necessary UOS in excess of an MUE value.

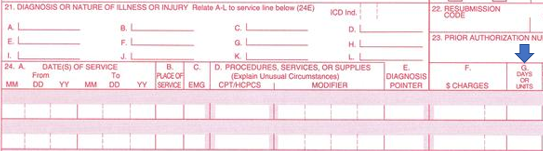

24.G is the field on the 1500 claim being audited for MUE compliance:

These edits are updated at least quarterly and revised in your practice management system through updates to the software.

Comprehensive Error Rate Testing (CERT) Program

CERT contractors perform a complex medical review of the claim and the supporting documentation to determine whether the claim was paid appropriately according to Medicare coverage, payment, coding, and billing rules.

CMS calculates a national Medicare Fee-For-Service (FFS) improper payment rate and improper payment rates by service type to accurately measure the performance of the MACs and gain insight into the causes of errors. CMS publishes the results of these reviews annually.

The Medicare FFS Improper Payment Rate is a good indicator of how claim errors in the Medicare FFS Program impact the Medicare Trust Fund. CERT errors are listed by the following categories:

The Recovery Audit Program

Most hospitals and clinics are familiar with the “RAC” or Recovery Audit Contractor program – now referred to as the “Recovery Audit Program” by CMS.

RAC's review claims on a post-payment basis by auditing past Medicare FFS claim data for potential overpayments or underpayments and reviewing medical records when necessary to make appropriate determinations. When performing these reviews, Recovery Auditors follow Medicare regulations, billing instructions, National Coverage Determinations (NCDs), coverage provisions, and the respective MAC’s Local Coverage Determinations (LCDs). Recovery Auditors do not develop or apply their own coverage, payment, or billing policies.

In general, Recovery Auditors do not review a claim previously reviewed by another entity. Recovery Auditors analyze claim data using their proprietary software to identify claims that clearly or likely contain improper payments.

Medical Review Audits

Medical reviews identify errors through claims analysis and/or medical record review activities. Contractors use this information to help ensure they provide proper Medicare payments (and recover any improper payments if the claim was already paid). Contractors also provide education to help ensure future compliance.

A Medicare contractor may use any relevant information they deem necessary to make a prepayment or post-payment claim review determination. This includes any documentation submitted with the claim or through an additional documentation request.

One of the first items reviewed is a valid authentication or signature. Next, auditors typically review documentation for medical necessity; information to support units, laterality, diagnosis coding and supporting documentation such as signed orders or plan of care.

Learn more about clean claims, prompt pay laws, fighting denials based on medical necessity, appealing ERISA denials, the Medicare appeals process, and how to create an effective denials and appeals program – click here and become an Outpatient Clinical Appeals Specialist. Click Here to see if we have any upcoming classroom training camps!